Less merchandise inventory, December 31, 20XX Under the periodic inventory system, the cost of goods sold is computed as demonstrated with this example of the Geyer Co.:įor the year ended December 31, 20XX Sales Revenue, net

Inventory amounts for the monthly and quarterly financial statements are usually estimates. The cost of goods sold is readily available in the account Cost of Goods Sold.Ĭomputing the Inventory under the Periodic Inventory MethodĪt the end of an accounting year, the company’s ending inventory is normally computed based on a physical count of its inventory items.Requires a physical inventory to correct any errors in the Inventory account.Has a continuously or perpetually changing balance because of the above entries.Is credited for the cost of the items sold (and the account Cost of Goods Sold is debited).Is debited whenever there is a purchase of goods (there is no Purchases account).In a perpetual system, the Inventory account: The periodic inventory system requires a calculation to determine the cost of goods sold.Requires a physical inventory at least once per year and estimates within the year.Must be adjusted at the end of the accounting year in order to report the costs actually in inventory.since these are recorded in accounts such as Purchases, Purchases Returns and Allowances, Purchases Discounts, etc. Excludes the cost of purchases, purchases returns and allowances, etc.Has only the ending balance from the previous accounting year.In a periodic system, the Inventory account: As a result, the company must compute an inventory amount at the end of each accounting period in order to report the amount of its ending inventory for its balance sheet and the cost of goods sold for its income statement. Hence, the Inventory account contains only the ending balance from the previous year.

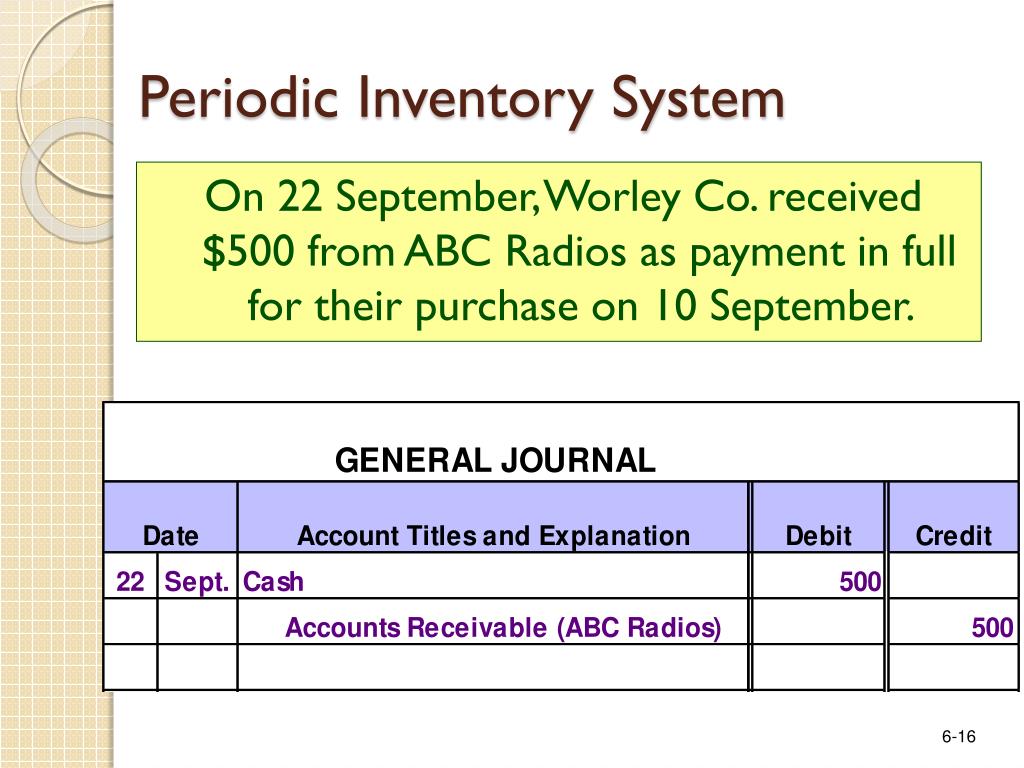

When goods are sold under the periodic inventory system, there is no entry to credit the Inventory account or to debit the account Cost of Goods Sold. When the balances of these three purchases accounts (Purchases, Purchase Discounts, and Purchase Returns and Allowances) are combined, the resulting amount is known as net purchases. Any adjustments related to these purchases of goods will later be credited to a GL contra account such as Purchases Discounts or Purchases Returns and Allowances. Rather than debiting Inventory, a company using periodic inventory debits a temporary account called Purchases. With a computerized perpetual inventory system, the GL is updated automatically, but the periodic system doesn’t allow that. One of the challenges of the periodic inventory method is making appropriate updates to the general ledger (GL). Compare and contrast periodic and perpetual inventory systems.One is a low volume specialty product that is produced on a demand pull basis, while the other is a high volume product that is produced on a push basis for inventory. When actual costs of individual units of merchandise can be determined from the accounting records?Īssume that a company produces two products in a manufacturing plant. Which of the following method is suitable for calculating the cost of inventory Regardless of how long it takes to produce and sell inventory, inventory is always The average inventory costing method which results in a changed unit inventory Purchases amounted to 100,000 and opening inventory was 34,000. Which type of inventory system is updated inventory system?ĭuring September, Khan had sales of 148,000, which made a gross profit of 40,000.

The inventory method that will always produce the same amount for cost of goods sold in a periodic inventory system as in a perpetual inventory system would be?

0 kommentar(er)

0 kommentar(er)